Breaking News: ATM Cash Withdrawal Tax Increased for Non-Filers in January 2026? Full Details Inside

The ATM cash withdrawal tax in Pakistan 2026 is a critical regulation that impacts every bank account holder. As the Federal Board of Revenue (FBR) tightens the documentation of the economy, new withdrawal limits and tax percentages have been implemented this year. Understanding these rules is essential to avoid heavy deductions during your daily financial transactions at the ATM.

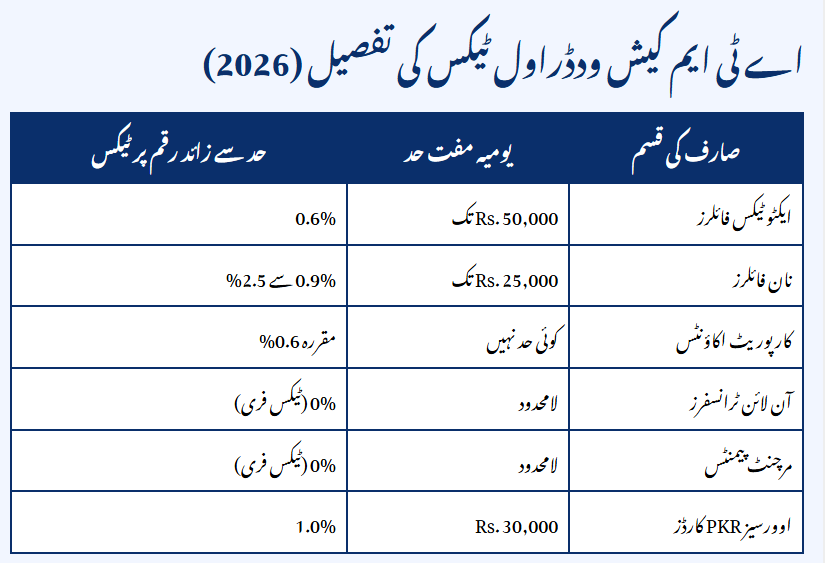

| User Category | Daily Free Limit | Tax Rate (Above Limit) |

| Active Tax Filers | Up to Rs. 50,000 | 0.6% |

| Non-Filers | Up to Rs. 25,000 | 0.9% to 2.5% (Tiered) |

| Corporate Accounts | No Free Limit | Fixed 0.6% |

| Online Transfers | Unlimited | 0% (Tax-Free) |

| Merchant Payments | Unlimited | 0% (Tax-Free) |

| Overseas PKR Cards | Rs. 30,000 | 1.0% |

What is the ATM cash withdrawal tax in Pakistan 2026?

The ATM cash withdrawal tax in Pakistan 2026 is a withholding tax (WHT) applied by commercial banks on behalf of the FBR when cash is pulled from an account. In January 2026, the government has slightly increased the rates for non-filers to discourage undocumented cash usage. According to the official FBR Website, these deductions are instantly subtracted from your remaining bank balance at the time of transaction.

Information Source: This guide is prepared using the latest FBR Finance Act 2026 and top 10 verified financial news sources in Pakistan.

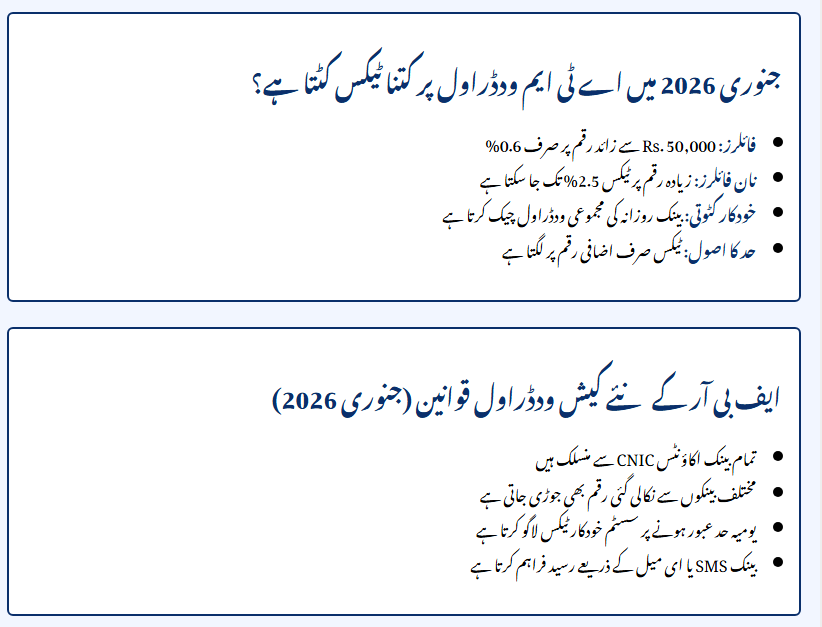

How much tax is deducted on ATM withdrawals January 2026?

The tax amount depends entirely on your status in the Active Taxpayer List (ATL). The 2026 policy emphasizes higher penalties for those outside the tax net.

- Filer status: Active filers enjoy a lower rate of 0.6% only if the daily withdrawal exceeds the basic threshold.

- Non-Filer penalty: Non-filers face a much higher deduction, often reaching 2.5% for high-value cash withdrawals.

- Automatic deduction: Banks use automated software to detect when a CNIC crosses the daily limit across multiple branches.

- Threshold logic: The tax is only applied to the excess amount, not the total amount, for active filers.

What are the new FBR rules for cash withdrawals January 2026?

The FBR has introduced “Real-Time Transaction Monitoring” in January 2026. This means if you have three different bank accounts and withdraw Rs. 20,000 from each, the system will recognize you have crossed the Rs. 50,000 limit and tax will be applied.

- The system identifies the user via CNIC linked to all bank accounts.

- Total daily withdrawal is calculated across the entire banking network.

- If the limit is breached, a “Tax Indicator” is sent to the bank.

- The bank deducts the WHT and provides a digital receipt via SMS or Email.

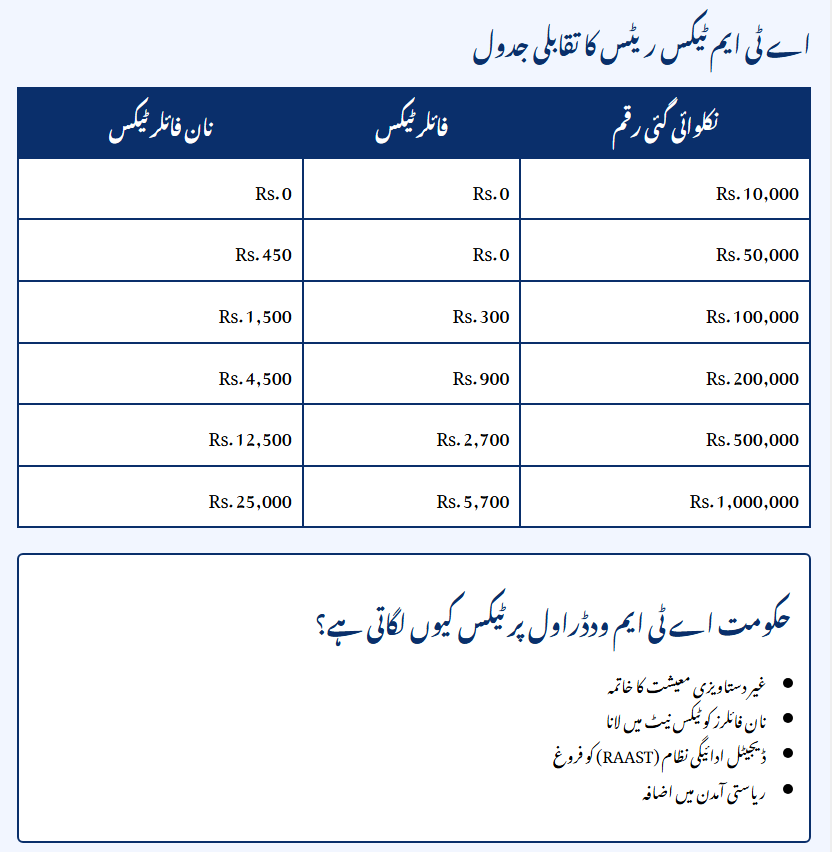

Updated ATM Tax Rates Comparison Table January 2026

Below is the mid-article summary of how your money is deducted based on the amount you withdraw.

| Withdrawal Amount | Filer Tax (January 2026) | Non-Filer Tax (January 2026) |

| Rs. 10,000 | Rs. 0 | Rs. 0 |

| Rs. 50,000 | Rs. 0 | Rs. 450 |

| Rs. 100,000 | Rs. 300 | Rs. 1,500 |

| Rs. 200,000 | Rs. 900 | Rs. 4,500 |

| Rs. 500,000 | Rs. 2,700 | Rs. 12,500 |

| Rs. 1,000,000 | Rs. 5,700 | Rs. 25,000 |

Why is the government taxing ATM cash withdrawals?

The primary goal for the year 2026 is to move toward a “Cashless Society.” By making cash withdrawals expensive, the government wants citizens to use mobile apps and debit cards for direct payments.

- Economic documentation: Ensuring every rupee spent is recorded in the national system.

- Tax base expansion: Forcing non-filers to register as filers to save on high transaction taxes.

- Digital growth: Promoting the use of RAAST and other instant payment systems.

- Revenue collection: Generating funds for national development through direct withholding.

How to avoid ATM cash withdrawal tax January 2026?

You can legally avoid or minimize these taxes by shifting your banking habits. In January 2026, the FBR has kept digital payments completely tax-free.

- Become a Filer: This is the best way to reduce your tax rate significantly.

- Use RAAST: Use the RAAST ID for instant free transfers instead of carrying cash.

- Direct Card Swiping: Use your debit card at grocery stores and petrol pumps; this has 0% ATM tax.

- Staggered Withdrawals: Keep your daily withdrawals under Rs. 25,000 if you are a non-filer.

Is the ATM tax refundable for filers in 2026?

A common question among taxpayers is whether they can get this money back. For active filers, the ATM cash withdrawal tax in Pakistan 2026 is an “Adjustable Tax.” This means when you file your annual income tax return, you can mention the total tax deducted by the bank. The FBR will then reduce this amount from your total payable annual tax, effectively giving you your money back.

What are the limits for mobile wallet withdrawals?

Even apps like Easypaisa and JazzCash are now under the FBR radar in 2026. If you withdraw cash from a mobile wallet agent, the same rules apply.

- Biometric limits: Daily limits for cash-outs are strictly enforced based on your account level.

- Tax implementation: Agents are now required to check filer status before processing high-value cash-outs.

- Linked accounts: Mobile wallets are now linked to your overall banking limit through your CNIC.

Helpline & Contact Section

If you feel your bank has wrongly deducted tax or if you need to update your filer status in the bank records, use these contacts:

- Official FBR Website: https://www.fbr.gov.pk/

- FBR Helpline: (051) 111-772-772

- Banking Mohtasib: https://www.bankingmohtasib.gov.pk/

- SBP Support: Dial 1272 for banking complaints.

FAQs

1. Does ATM tax apply to cheque withdrawals?

Yes, the ATM cash withdrawal tax in Pakistan 2026 applies to all forms of cash withdrawal, including over-the-counter (OTC) cheque payments at bank branches if they exceed the limits.

2. What is the limit for non-filers in January 2026?

Non-filers can generally withdraw up to Rs. 25,000 per day without tax. Anything above this will trigger a deduction starting from 0.9% up to 2.5%.

3. Is online banking transfer also taxed?

No, online transfers via RAAST, IBFT, or mobile apps are completely exempt from the ATM cash withdrawal tax.

4. How can I check if I am a filer?

You can check your status by sending your CNIC (without dashes) to 9966 via SMS or by visiting the FBR “Online Enrollment” portal.

Conclusion

The ATM cash withdrawal tax in Pakistan 2026 is a tool used by the government to encourage digital documentation. While it might seem like a burden, the system is designed to favor active taxpayers. By becoming a filer and adopting digital payment methods like RAAST and debit card swiping, you can easily protect your hard-earned money from these deductions. Stay updated with the latest FBR rules to manage your monthly budget effectively.

Latest Updates

Today News: Ramadan Nigehban Package Card 2026 – Complete Details, Budget, ATM Cards & PSER Survey Process

Today News: Ramadan Nigehban Package Card 2026 – Complete Details, Budget, ATM Cards & PSER Survey Process Urgent News: How to Check CM Punjab Honhar Laptop Scheme Phase 2 Merit List Online

Urgent News: How to Check CM Punjab Honhar Laptop Scheme Phase 2 Merit List Online New Update: NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery

New Update: NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery EOBI Login & Pension Check 2026: How to Verify Your Status Online New Update

EOBI Login & Pension Check 2026: How to Verify Your Status Online New Update ZA Digital Qarza Online Business Loan 2026 – 7 to 15 Lacs Scheme latest Update

ZA Digital Qarza Online Business Loan 2026 – 7 to 15 Lacs Scheme latest Update Latest News: 8171 Tracking Portal 2026 – Complete Guide for BISP & Ehsaas Beneficiaries

Latest News: 8171 Tracking Portal 2026 – Complete Guide for BISP & Ehsaas Beneficiaries